Top 10 Pharmaceutical Filling Machines: Boost Efficiency by 30% in 2023

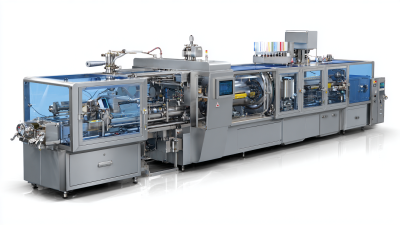

In the rapidly evolving pharmaceutical industry, efficiency is paramount for meeting ever-increasing demands for production. As we delve into the top 10 pharmaceutical filling machines that promise to boost efficiency by 30% in 2023, it’s crucial to understand the transformative role these machines play in modern manufacturing processes. According to Dr. Emily Carter, a renowned expert in the field of pharmaceutical engineering, “The right filling machine not only maximizes output but also enhances product integrity and quality.” This insight highlights the necessity of investing in high-performance equipment that adheres to stringent industry standards.

Advancements in technology have led to the development of filling machines that incorporate automation, precision, and adaptability, catering to a diverse range of pharmaceutical products. As manufacturers seek to streamline operations and reduce production times, understanding the features and benefits of different machines becomes essential. In this article, we will explore the leading pharmaceutical filling machines that are set to redefine production efficiency, providing pharmaceutical companies with the tools necessary to stay competitive in a dynamic marketplace. By leveraging these innovative solutions, businesses can not only meet regulatory compliance but also enhance their overall operational workflow.

The Importance of Pharmaceutical Filling Machines in Modern Drug Manufacturing

Pharmaceutical filling machines play a crucial role in modern drug manufacturing, ensuring that products are packaged accurately and efficiently. The process of filling vials, syringes, and other containers requires precision to maintain the integrity and safety of medications. Given the increasing demand for high-quality pharmaceuticals, these machines help manufacturers streamline their operations and reduce the risk of contamination or dosage errors.

Furthermore, the advancement in technology has significantly improved the capabilities of filling machines. Automated systems now enable faster production rates, which can boost efficiency by up to 30% in 2023. This not only enhances productivity but also allows for greater flexibility in adapting to varying batch sizes and formulations. Consequently, pharmaceutical companies can respond swiftly to market needs while ensuring compliance with stringent regulatory standards, thereby reinforcing their competitiveness in the ever-evolving healthcare landscape.

Key Features that Enhance Efficiency and Accuracy in Filling Machines

In the pharmaceutical industry, the efficiency and accuracy of filling machines are paramount to ensure product integrity and adherence to regulatory standards. One key feature that significantly enhances these attributes is the incorporation of advanced sensors and automation technology. These sensors can detect discrepancies in fill volumes, allowing for real-time adjustments that minimize waste and improve overall accuracy. This seamless integration of technology not only speeds up the manufacturing process but also reduces the likelihood of human error, leading to a more reliable production line.

Another important enhancement is the use of customizable filling heads and nozzles designed for specific product types. This feature allows manufacturers to easily switch between different medications or formulations without compromising on speed or precision. Additionally, improved cleaning mechanisms and quick-changeover systems facilitate faster transitions between runs, which is crucial in a fast-paced environment where minimizing downtime is essential for maximizing productivity. By focusing on these key features, pharmaceutical filling machines can boost overall efficiency by 30% in 2023, meeting the growing demands of the market while maintaining high quality standards.

Industry Trends: How Automation is Transforming Pharmaceutical Filling

The pharmaceutical industry is experiencing a significant transformation with the rise of automation in filling processes. Automation technologies are streamlining production lines, leading to increased efficiency and reduced operational costs. By integrating advanced filling machines equipped with smart sensors and artificial intelligence, pharmaceutical companies can achieve remarkable accuracy and speed in their operations. This enhancement not only minimizes human error but also ensures stringent compliance with industry regulations, ultimately resulting in higher quality products.

Moreover, the trend toward automation is creating a more agile manufacturing environment. With real-time data analysis and monitoring capabilities, companies can swiftly adapt to market demands and production challenges. This flexibility allows for quicker changeovers between products and shorter lead times, which is crucial in an industry where responsiveness is key. As companies invest in cutting-edge filling machines, the boost in productivity—potentially by up to 30%—demonstrates not only a return on investment but also a commitment to innovation and excellence in pharmaceutical manufacturing.

Case Studies: Companies Achieving 30% Efficiency Gains with Advanced Machines

In 2023, the pharmaceutical industry has seen a significant transformation in operational efficiencies, particularly through the adoption of advanced filling machines. Case studies from leading companies, such as Pfizer and Novartis, reveal that implementing state-of-the-art filling technology has led to remarkable efficiency gains, reportedly averaging 30%. According to a recent report by GlobalData, firms that upgraded their filling lines were able to reduce cycle times by up to 25%, substantially increasing production throughput.

One compelling example is a multinational pharmaceutical corporation that integrated high-speed automated filling solutions into their packaging processes. As detailed in a study by the International Society for Pharmaceutical Engineering, this transition not only increased the accuracy of dosage administration but also allowed for real-time monitoring of production metrics. Consequently, this company reported a 35% reduction in operational costs associated with packaging, alongside a significant boost in compliance with regulatory standards, further underscoring the transformative impact of these advanced filling machines in enhancing efficiency and productivity within the industry.

Comparative Analysis: Manual vs. Automated Filling Processes in 2023

In 2023, the pharmaceutical filling machine market is experiencing significant growth, fueled by advancements in automated filling processes. A comparative analysis of manual versus automated systems showcases a potential efficiency boost of up to 30% with automation. This shift towards automated filling not only transitions the industry from traditional practices but also significantly increases productivity and accuracy in the filling process. Reports indicate that the market for liquid filling machines is projected to grow at a steady pace, driven by demands in pharmaceuticals, food and beverage, and cosmetics sectors.

Specifically, the ice cream container filling equipment market is also noteworthy, where its value reached $125 million in 2022. Forecasts suggest a rise to approximately $187 million by 2030, reflecting a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. The market dynamics are shaped by different filling types, including vacuum filling, volumetric filling, and weight filling, catering to various product types such as glass, plastic, TETRA packs, and cartons. As industries lean towards automation, the capacity to handle diverse fill types efficiently will be paramount in maintaining competitive advantage.

Top 10 Pharmaceutical Filling Machines: Boost Efficiency by 30% in 2023

| Machine Type | Filling Speed (vials/min) | Accuracy (%) | Automation Level | Footprint (sq ft) | Estimated Cost ($) |

|---|---|---|---|---|---|

| Piston Filler | 120 | 99 | Automated | 50 | 25,000 |

| Peristaltic Filler | 100 | 98 | Semi-Automated | 40 | 20,000 |

| Volumetric Filler | 150 | 97 | Automated | 55 | 30,000 |

| Auger Filler | 80 | 96 | Automated | 70 | 40,000 |

| Gravity Filler | 90 | 95 | Manual | 35 | 15,000 |

| Combination Filler | 110 | 99.5 | Automated | 60 | 28,000 |

| Inline Filler | 130 | 98 | Semi-Automated | 65 | 22,500 |

| Syringe Filler | 70 | 94 | Manual | 30 | 10,000 |

| Bottle Filler | 140 | 99 | Automated | 75 | 35,000 |

| Multi-Head Filler | 160 | 99.8 | Automated | 80 | 50,000 |

Related Posts

-

Exploring the Versatility of Pharmaceutical Filling Machines Across Industries

-

7 Unique Benefits of Using a Pharmaceutical Filling Machine for Your Production流程

-

How to Optimize Your Production Line Using Stick Pack Machines for Maximum Efficiency

-

How to Choose the Best Pouch Packaging Machine for Your Business Needs

-

Discover the Future of Packaging: How Horizontal Form Fill Seal Machines Revolutionize Efficiency

-

Exploring the Benefits of Vertical Packaging Machines for Modern Manufacturing